In the fast-paced world of financial markets, where timing and strategy are everything, traders are constantly seeking tools that can give them an edge. TradeTron, an advanced algo trading platform, has emerged as a game-changer in this domain. Whether you’re an experienced trader looking to automate complex strategies or a newcomer interested in exploring algorithmic trading, TradeTron offers a versatile solution. This review will dive deep into what makes TradeTron stand out, its key features, and how it can benefit different types of traders.

What is TradeTron?

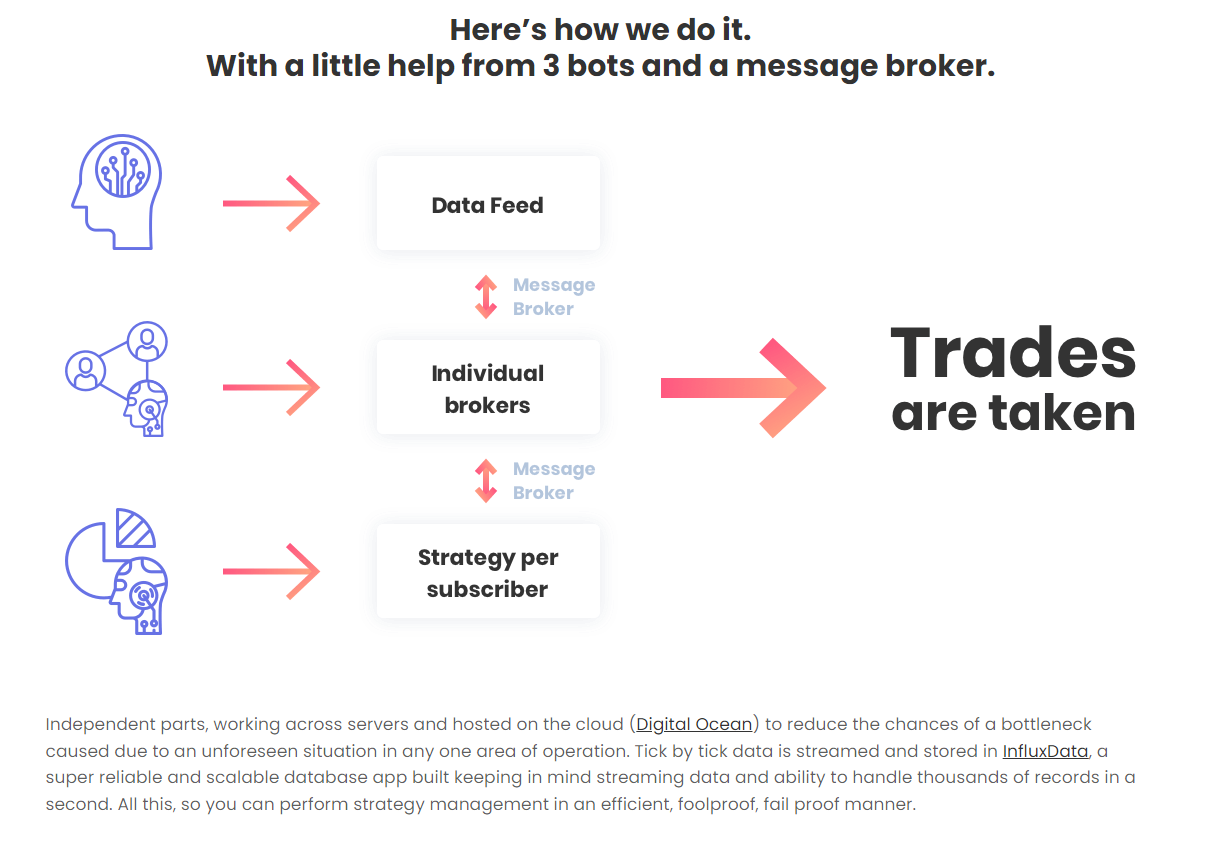

TradeTron is a cloud-based platform designed to automate trading strategies. It caters to traders, investors, and portfolio managers who want to design, test, and deploy trading strategies across multiple asset classes. The platform supports various exchanges and brokers, making it a comprehensive solution for those involved in the financial markets.

The platform’s appeal lies in its user-friendly interface, which allows both coders and non-coders to create strategies using simple yet powerful tools. Whether you’re interested in equities, commodities, or cryptocurrencies, TradeTron enables you to trade seamlessly and efficiently.

Who Can Benefit from TradeTron?

TradeTron is designed to cater to a wide range of users:

1. Individual Traders: Whether you’re a seasoned trader or a beginner, TradeTron’s versatile tools allow you to create and automate strategies tailored to your specific trading style. The ability to backtest and paper trade ensures that even novice traders can build and test strategies without the risk of losing money.

2. Portfolio Managers: For portfolio managers handling multiple accounts and asset classes, TradeTron offers a unified platform to manage all trading activities. The multi-exchange support and performance tracking features are particularly useful for managing diverse portfolios.

3. Strategy Developers: Developers with coding skills can take advantage of TradeTron’s Python Editor to create complex algorithms. Additionally, the marketplace provides an opportunity for developers to monetize their strategies by offering them to other users.

4. Educational Institutions: TradeTron is also a valuable tool for educational institutions teaching financial markets and algorithmic trading. The platform’s intuitive interface and comprehensive features make it an excellent resource for students learning about market dynamics and trading strategies.

Key Features of TradeTron

1. Strategy Creation: TradeTron’s strategy creation module is one of its most compelling features. Users can design trading strategies using either the Rule Builder or the Python Editor. The Rule Builder is a no-code, drag-and-drop interface that simplifies the process for those who may not have coding skills. For more advanced users, the Python Editor provides the flexibility to write custom algorithms using Python, a popular programming language in the finance industry.

2. Backtesting: Before deploying a strategy in live markets, it is crucial to validate its performance. TradeTron offers a robust backtesting environment where users can test their strategies against historical data. The backtesting feature allows traders to understand the potential profitability, drawdowns, and risk associated with their strategies, thus providing a more informed trading experience.

3. Multi-Exchange and Multi-Asset Support: One of the standout features of TradeTron is its support for multiple exchanges and asset classes. Whether you’re trading on the National Stock Exchange (NSE) of India, the New York Stock Exchange (NYSE), or the cryptocurrency markets, TradeTron provides seamless integration. This multi-asset support allows traders to diversify their portfolios and implement strategies across various markets without the need for multiple platforms.

4. Marketplace for Strategies: For those who prefer using pre-built strategies, TradeTron offers a marketplace where users can browse and purchase strategies created by other traders. This marketplace is a great resource for beginners who might not yet have the confidence to build their own strategies. Experienced traders can also monetize their successful strategies by listing them on the marketplace for others to use.

5. Live Deployment: Once a strategy has been created and backtested, TradeTron allows for live deployment across supported brokers and exchanges. The platform continuously monitors the market and executes trades based on the predefined strategy parameters. This level of automation ensures that traders do not miss out on opportunities due to human error or time constraints.

6. Paper Trading: For those who are not yet ready to deploy their strategies live, TradeTron offers a paper trading feature. This allows traders to simulate their strategies in real-time market conditions without risking actual capital. It’s an excellent way to build confidence and fine-tune strategies before going live.

7. Performance Tracking and Analytics: TradeTron provides detailed analytics and performance tracking for all strategies. Users can monitor various metrics such as return on investment (ROI), Sharpe ratio, maximum drawdown, and more. These insights help traders refine their strategies and make data-driven decisions.

8. Community and Support: TradeTron has built a vibrant community of traders who share ideas, strategies, and tips. The platform also offers comprehensive customer support, including tutorials, webinars, and a dedicated support team, ensuring that users have all the resources they need to succeed.

Why Choose TradeTron?

There are several reasons why TradeTron stands out in the crowded field of algo trading platforms:

1. User-Friendly Interface: TradeTron’s interface is intuitive and easy to navigate, making it accessible to both beginners and experienced traders.

2. Versatility: The platform’s support for multiple asset classes and exchanges makes it a versatile tool for traders looking to diversify their portfolios.

3. Robust Backtesting: The ability to backtest strategies with historical data provides valuable insights, allowing traders to optimize their strategies before going live.

4. Community and Support: TradeTron’s active community and comprehensive support resources ensure that users have all the help they need to succeed.

5. Affordable Pricing: With a range of pricing plans, TradeTron offers options for traders at all levels, from beginners to professionals.

Pricing Plans

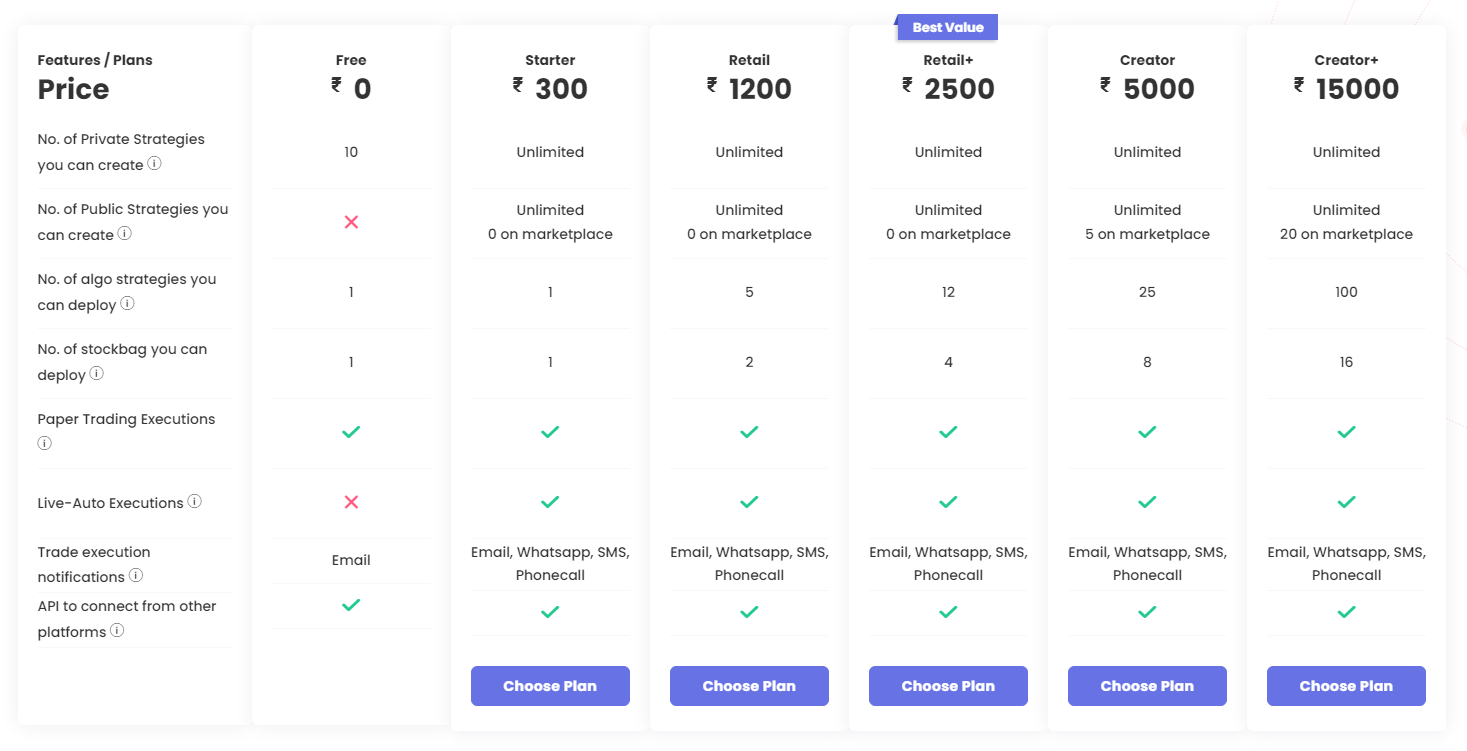

TradeTron offers a range of pricing plans to suit different needs:

1. Free Plan

- Price: ₹0

- Features:

- 10 Private Strategies

- 1 Public Strategy

- 1 Algo Strategy deployment

- Trade notifications via email

2. Starter Plan

- Price: ₹300

- Features:

- Unlimited Private and Public Strategies

- 1 Stockbag deployment

- 1 Paper Trading Execution

- Notifications via email, WhatsApp, SMS, and phone call

3. Retail Plan

- Price: ₹1200

- Features:

- Unlimited Private and Public Strategies

- 5 Stockbag deployments

- 2 Paper Trading Executions

- Notifications via email, WhatsApp, SMS, and phone call

4. Retail+ Plan

- Price: ₹2500

- Features:

- Unlimited Private and Public Strategies

- 12 Stockbag deployments

- 4 Paper Trading Executions

- Notifications via email, WhatsApp, SMS, and phone call

5. Creator Plan

- Price: ₹5000

- Features:

- Unlimited Private and Public Strategies

- 5 Strategies on the marketplace

- 25 Stockbag deployments

- 8 Paper Trading Executions

- Notifications via email, WhatsApp, SMS, and phone call

6. Creator+ Plan

- Price: ₹15000

- Features:

- Unlimited Private and Public Strategies

- 20 Strategies on the marketplace

- 100 Stockbag deployments

- 16 Paper Trading Executions

- Notifications via email, WhatsApp, SMS, and phone call

These plans cater to different needs, from beginners to professional traders.

Frequently Asked Questions (FAQs)

1. What is TradeTron?

TradeTron is a cloud-based platform designed for creating, testing, and automating trading strategies across multiple asset classes and exchanges. It offers tools for both coders and non-coders to design trading algorithms.

2. Can I use TradeTron if I don’t know how to code?

Yes, TradeTron offers a no-code Rule Builder that allows users to create trading strategies using a drag-and-drop interface. This makes it accessible to traders without any coding knowledge.

3. What types of assets can I trade on TradeTron?

TradeTron supports a variety of asset classes, including equities, commodities, forex, and cryptocurrencies. It also supports multiple exchanges, allowing users to trade on markets worldwide.

4. How does backtesting work on TradeTron?

Backtesting on TradeTron involves testing your trading strategies against historical market data to assess their performance. This feature helps you identify potential risks and rewards before deploying strategies in live markets.

5. Can I monetize my trading strategies on TradeTron?

Yes, TradeTron offers a marketplace where users can sell their trading strategies. If you have developed a successful strategy, you can list it on the marketplace for other traders to purchase.

Conclusion

In an industry where automation and precision are key, TradeTron offers a powerful solution for traders looking to enhance their trading strategies. Whether you’re a novice exploring algo trading for the first time or a seasoned professional managing complex portfolios, TradeTron provides the tools and support you need to succeed. Its blend of user-friendliness, versatility, and robust features make it one of the top choices in the algo trading platform space. Explore TradeTron today and take your trading to the next level.