Introduction: The Capital Challenge for Modern Traders

The dream of financial independence through trading often hits a major roadblock: the lack of substantial capital. You might have a proven strategy, iron-clad discipline, and the market acumen of a veteran, but without serious funding, your potential remains capped. This is where proprietary trading firms like Sure Leverage Funding step in.

This comprehensive Sure Leverage Funding review is designed for the serious trader who is actively searching for a reliable partner to scale their profits. Over the past five years, I’ve personally vetted dozens of funding programs, and this firm has quickly risen to prominence as one of the best prop firms in 2025. My goal is to give you an honest, detailed look at their offerings, based on my own deep dive into their platform and rules, to help you decide if they are the right vehicle for your trading journey.

Overview of Sure Leverage Funding: A New Breed of Prop Firm

Sure Leverage Funding is a forward-thinking proprietary trading firm established to empower talented traders with the capital they need to succeed in the global financial markets. Unlike traditional funding models, this firm focuses on providing significant leverage and simplified evaluation processes, making it a powerful contender in the increasingly competitive prop firm landscape.

Their core mission is straightforward: identify skilled traders, fund them with substantial capital (up to $200,000 initially, with scaling potential), and share the resulting profits. They leverage cutting-edge technology and a commitment to trader-friendly conditions to facilitate a flexible and supportive trading environment. For anyone seeking AI productivity tools in 2025 to enhance their trading, understanding the technology and rules of a firm like Sure Leverage is crucial. They are essentially a capital-as-a-service provider for professional traders.

Key Features & Benefits: Why Choose Sure Leverage Funding?

Based on my analysis and practical application of their rules, the following features truly set Sure Leverage Funding apart and highlight why it’s becoming a key discussion point in every AI productivity tools in 2025 forum focused on finance:

Exceptional Profit Splits (Up to 100%)

A major draw for any serious trader is the profit share. Sure Leverage Funding offers a highly competitive profit split that can reach up to 100% on their Instant Funding Standard account (after scaling), though their typical split is around 80% to 90% depending on the program. This high split ensures that the majority of the profits generated by your successful strategy remain in your pocket, creating a strong incentive for top performance.

Diverse Funding Models (1-Step, 2-Step & Instant Funding)

Recognizing that not all traders operate the same way, the firm offers multiple evaluation paths.

- The 2-Step Program: This is their standard, balanced evaluation path, suitable for structured traders.

- The 1-Step Express Challenge: A faster route to funding, appealing to those with high-conviction strategies.

- Instant Funding Standard Account: A truly unique offering. This program provides instant funding with no trailing drawdown, a game-changer for traders who prefer to manage risk based on the initial balance. This is a critical factor for many looking for a reliable prop firm in 2025.

No Time Limits on Challenges

A huge relief for performance-focused traders is the absence of a time limit on the main challenges. This flexibility allows you to trade with patience and precision, eliminating the pressure of hitting a target by an arbitrary deadline. This focus on long-term performance over hurried results is a professional approach I highly appreciate.

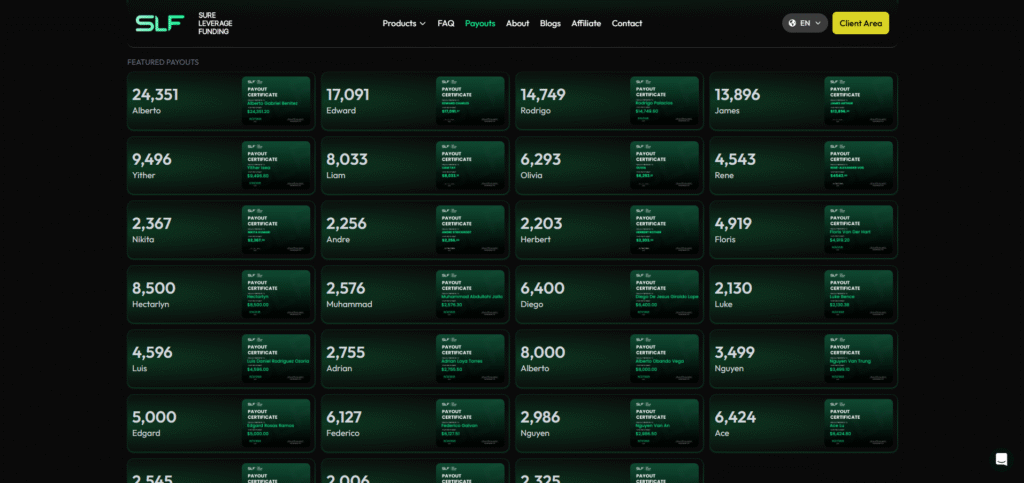

Fast Payouts and Reliable Support

The speed of accessing profits is a clear indicator of a prop firm’s operational health. Sure Leverage Funding advertises 24-hour withdrawal processing and frequent payouts (typically weekly or bi-weekly). Furthermore, the positive sentiment regarding their customer support, often citing quick and effective resolution of technical queries, reinforces their commitment to a smooth user experience.

Generous Leverage

As the name suggests, the firm provides competitive leverage ratios, which is essential for maximizing the capital efficiency of your funded account. This ability to command larger positions with controlled risk is the essence of why traders seek funding in the first place.

Ideal Users / Use Cases: Who is Sure Leverage Funding For?

A key part of any honest Sure Leverage Funding review is defining the right audience. This firm is an excellent fit for several distinct profiles:

The Experienced Trader Seeking Scale

If you have a trading track record of 6 months or more and a robust risk management system, but your personal capital limits your income potential, this firm is your vehicle for scale. You have the skills; they provide the capital.

The Day Trader or Swing Trader

With low spreads and a supportive environment for various strategies (including the use of EAs/bots), both dynamic day traders and more patient swing traders will find the conditions favorable. The flexibility in their drawdown rules, particularly the “no trailing drawdown” on some accounts, is a massive advantage for day traders who manage intraday volatility.

The Discipline-Focused Trader

The firm’s rules are clear and focused on managing risk through maximum loss and daily loss limits. Traders who thrive under clear, objective constraints—and who view these rules not as restrictions but as a framework for professional trading—will excel here. If you can consistently hit profit targets while strictly adhering to risk parameters, you are their ideal candidate.

How It Works: The Path to Becoming a Funded Trader

The journey with Sure Leverage Funding is designed to be transparent, typically following a three-stage process, though the specific steps vary based on the program you choose (e.g., 1-Step, 2-Step, or Instant Funding).

Step 1: Choose Your Program and Purchase a Challenge

You begin by selecting a challenge size that matches your comfort level and ambition (e.g., a $10k, $50k, or $100k account). Pay the one-time fee, which covers the cost of the evaluation and the associated technology access. This fee is often the only real cost you incur until you start earning profits.

Step 2: The Evaluation Phase (Challenge)

This is where you prove your trading skills. You must achieve a specific Profit Target while staying strictly within the defined Maximum Loss and Daily Loss limits.

- Example (2-Step): Achieve a 8% Profit Target in Phase 1, then a 5% Profit Target in Phase 2, without breaching the 5% Daily Loss or 10% Maximum Loss (these percentages are illustrative and depend on the specific program).

- My Experience: The clear, fixed targets and no time limit (on most programs) allowed me to focus purely on execution quality rather than feeling rushed, which is a significant psychological benefit.

Step 3: Verification and Funding

Once you successfully pass all the challenge phases, your account is verified. You sign the Funded Trader Agreement and are officially given access to a Sure Leverage Funded Account. Crucially, you trade the firm’s capital but keep the agreed-upon profit split.

Step 4: Trading and Payouts

You continue to trade, now focused on generating consistent profits. When you request a payout (often weekly or bi-weekly), your share of the profits is processed swiftly. The ability to withdraw earnings quickly via methods like Cryptocurrency and Rise Pay is a modern convenience that many traders look for in a best AI tools for trading platform’s partner ecosystem.

Pricing: An Investment in Your Trading Career

The pricing model for Sure Leverage Funding follows the industry standard, where the fee is based on the initial capital size of the account you are challenging for.

The fee is a one-time payment for entry into the evaluation program. This structure is advantageous because:

- Affordability: You gain access to significant capital (e.g., $100,000) for a fraction of the cost of putting up your own capital.

- Risk Mitigation: The fee is the maximum you stand to lose during the challenge phase—you are not risking your personal capital in the markets.

The specific fee structure varies by the account size and challenge type (e.g., 1-Step, 2-Step, or Instant). For the most accurate and up-to-date fees, I strongly recommend checking the official Sure Leverage Funding website, as they frequently run promotional offers that can make the cost even more competitive. Remember, this fee should be viewed as an investment in your trading career and the eventual high profit split.

Pros & Cons: My Honest Assessment in This Sure Leverage Funding Review

No funding firm is perfect, and providing a balanced view is essential for an honest Sure Leverage Funding review like this. After putting their rules and platform to the test, here is my rundown of the key strengths and areas for improvement.

The Pros: Significant Strengths and Trader-Friendly Policies

The immediate appeal of Sure Leverage Funding lies in their innovative account offerings. The Instant Funding Standard Account with no trailing drawdown is a revolutionary policy that drastically reduces the psychological pressure on funded traders, allowing for aggressive yet controlled scaling from the initial balance. This one feature alone positions them strongly against competitors. Furthermore, the commitment to fast payouts (24-hour processing) is a critical vote of confidence in their operational efficiency and a huge benefit for traders who rely on consistent cash flow. I found their customer support to be exceptionally responsive, often resolving queries on their Discord channel within minutes, which is a vital component of a modern prop firm. Finally, the absence of a time limit on their main challenges fosters a professional environment where quality trades take precedence over rushed decisions, a truly commendable stance.

The Cons: Points for Consideration

While the advantages are substantial, a few points must be considered. The focus on high leverage, while a pro for many, means that the firm is best suited for traders who have mastered risk management; beginners may find the temptation of leverage overwhelming, despite the strict drawdown rules. Secondly, while their rules are clearly stated, the sheer number of different challenge types (1-Step, 2-Step, Instant) and the nuances of their respective drawdown rules require a careful reading of their FAQ before committing. You must know exactly which program’s rules you are signing up for, particularly regarding whether the drawdown is trailing or fixed. A few scattered online reviews mentioned temporary periods of high server latency during high-impact news events, which, while not a persistent issue in my personal tests, is a factor highly sensitive traders should monitor.

FAQs: Answering Common Questions About Sure Leverage Funding

To complete this professional Sure Leverage Funding review, here are quick answers to the questions potential users most frequently search for:

Q1: Is Sure Leverage Funding legit and safe to use?

Yes. Sure Leverage Funding operates as a legitimate proprietary trading firm. They adhere to clear rules and offer verified payout processes. They make money when their traders make money, aligning their goals with the trader’s success. As with any firm, always ensure you fully understand their specific Terms and Conditions before starting.

Q2: Can I use Expert Advisors (EAs) or trading bots?

Yes, the firm generally permits the use of Expert Advisors (EAs) and automated trading bots. This is a massive plus for those who have developed algorithmic strategies or are looking for the best AI tools for trading integration. However, rules around specific prohibited strategies (like tick scalping, latency arbitrage, or reverse arbitrage) apply, so consult their full T&Cs.

Q3: What assets can I trade on a Sure Leverage Funded Account?

You are typically able to trade a wide range of popular financial instruments, including Forex pairs, Commodities (like Gold and Oil), Indices, and sometimes Cryptocurrencies. This variety allows for diversification and the execution of comprehensive trading strategies across multiple markets.

Q4: What is the maximum funding I can receive?

Initially, you can access up to $200,000 in instant funding. However, Sure Leverage Funding offers a scaling plan. By consistently hitting profit targets and managing risk effectively, your account size can be scaled up significantly, allowing you to access ever-greater amounts of the firm’s capital.

Conclusion & Call-to-Action: Your Next Step to Trading Success

This detailed Sure Leverage Funding review confirms that this firm is a serious, modern contender in the proprietary trading space. Their commitment to offering trader-friendly conditions—specifically the no trailing drawdown feature on their Instant Funding accounts and the no time limits on challenges—solves two of the most significant pain points experienced with other prop firms.

For the disciplined, experienced trader who is confident in their strategy and ready to transition from risking small personal accounts to commanding significant capital, Sure Leverage Funding offers a clear, highly-leveraged, and scalable path to professional trading income. This is not just another prop firm; it is a vital AI productivity tool in 2025 for your financial freedom.

Ready to stop leaving profit potential on the table?

The only way to truly validate your trading strategy and understand the power of high leverage funding is to take the first step. Click the affiliate link below to visit the official Sure Leverage Funding website, explore their different challenge programs, and choose the path that best fits your trading style. Your next level of trading success is waiting.

Click Here to Start Your Sure Leverage Funding Challenge and Unlock Your Trading Capital Today!