As the real estate landscape undergoes constant evolution and intensifies in competition, the necessity for agents to embrace technology to maintain a competitive edge becomes ever more apparent. Among the platforms gaining traction within the real estate sector is DealCheck.

In this comprehensive review, we delve into DealCheck and its array of services, aiming to assist you in determining whether subscribing to it is a worthwhile investment in your real estate endeavors.

What is DealCheck?

DealCheck is an online platform specifically crafted for real estate investors seeking to evaluate and compare potential investment properties. It provides comprehensive analyses, generating reports that cover cash flow projections, internal rate of return, rehabilitation budgets, and expected closing expenses.

Tailored to accommodate both beginners and experienced investors, users can input specific details such as acquisition costs, repair estimates, listing prices, and other relevant property information. Through this process, DealCheck produces thorough analyses, assisting investors in making well-informed, data-driven decisions.

Whether exploring rental opportunities, renovation projects, or wholesale prospects, DealCheck offers invaluable insights. However, it remains crucial for users to supplement this tool with their own due diligence and professional real estate guidance.

Who is DealCheck Best For?

- Real Estate Investors: Whether you’re a novice or seasoned investor, DealCheck is your go-to solution for efficiently analyzing and comparing potential real estate investments.

- Property Owners: If you’re a property owner exploring the rental market, DealCheck offers invaluable assistance by providing rental comparisons and projecting potential cash flows.

- Wholesalers: DealCheck serves as an indispensable tool for wholesalers, enabling swift analysis of a property’s profitability before finalizing any purchase decisions.

Key Features of DealCheck

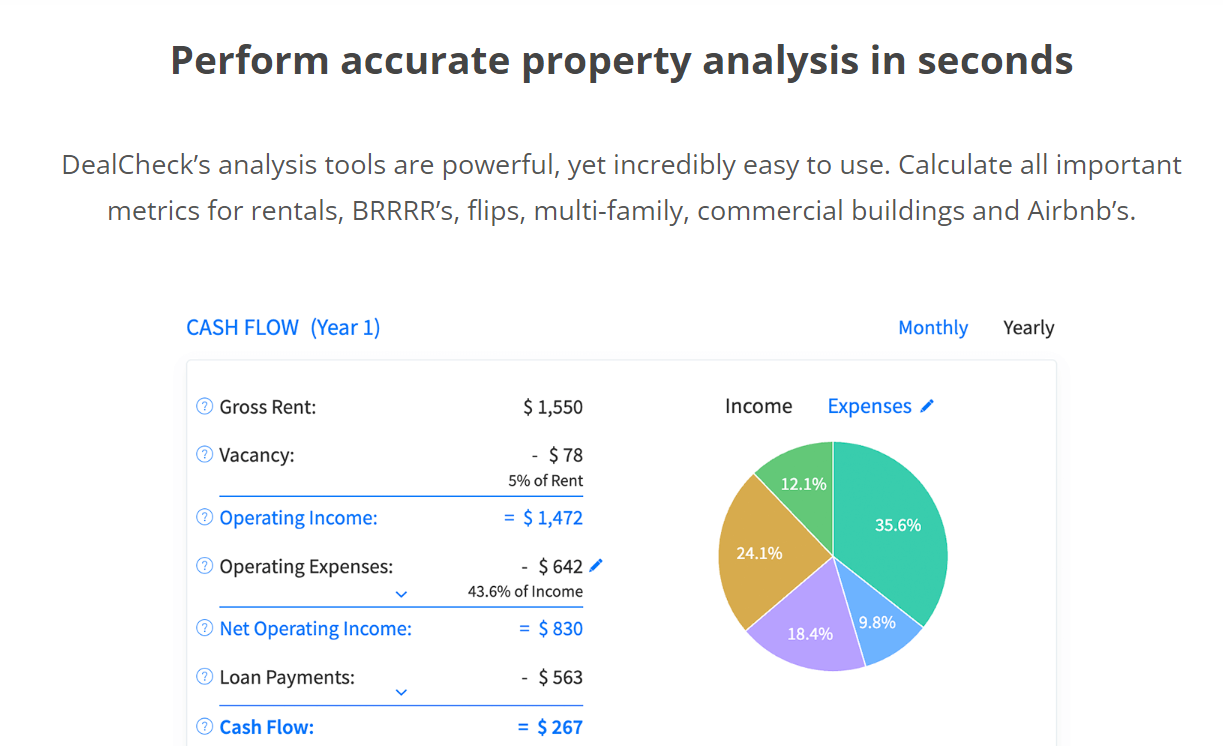

- Perform Accurate Property Analysis in Seconds: Say goodbye to cumbersome spreadsheets with DealCheck’s intuitive and robust property analysis tools. This software is tailored to compute all vital metrics for a diverse array of properties, encompassing rentals, BRRRRs, flips, multi-family residences, commercial buildings, and Airbnb rentals.

- Import Property Data from Public Records: Easily retrieve essential property details such as list price, estimated value and rent, property taxes, HOA fees, and photos by searching public records and online listings. This feature encompasses a wide range of US properties.

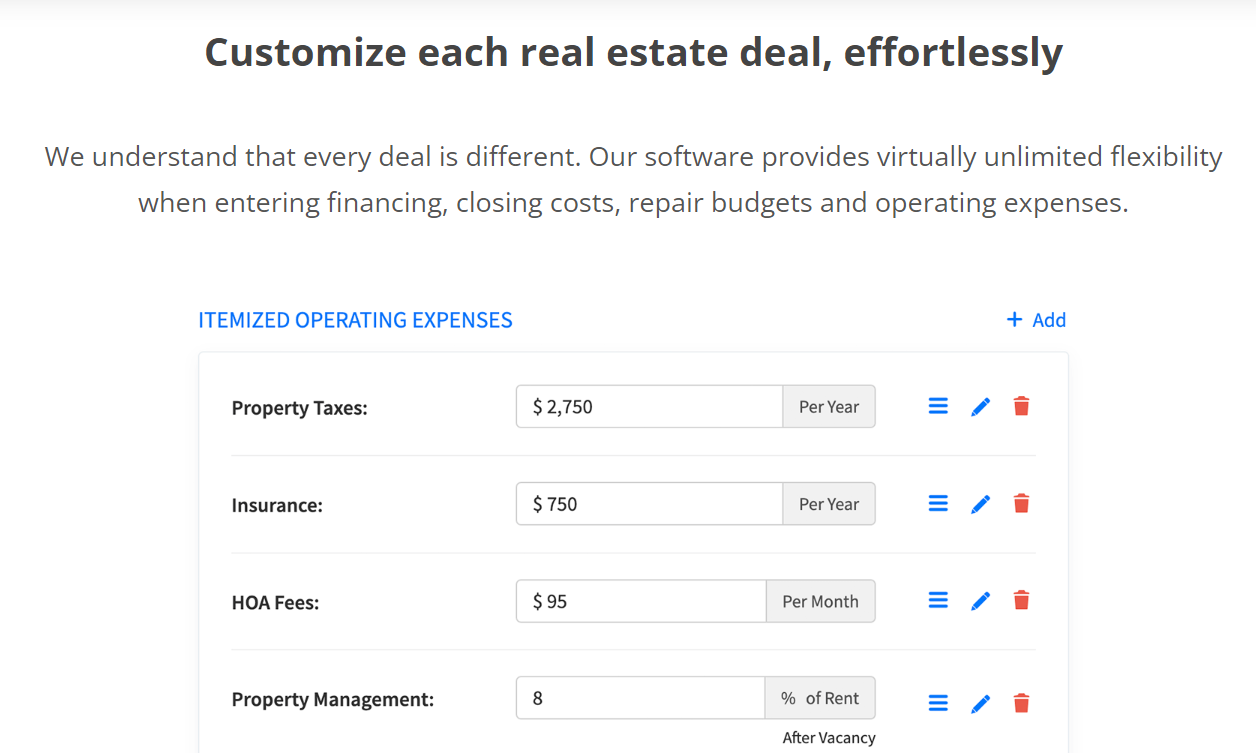

- Customization for Every Deal: Recognizing the uniqueness of each deal, DealCheck provides unparalleled flexibility in inputting details regarding financing, closing costs, repair budgets, and operating expenses.

- Cash Flow and Profit Projections: Utilize DealCheck’s real estate calculator to assess long-term cash flow projections for rental properties and profit projections for flips. Modify deal parameters effortlessly and observe their immediate impact on profit and returns.

- Lookup Sales and Rental Comps: Confidently determine after repair values and potential rents using recent sales comps, comparable rental listings, and market statistics. This feature is accessible for most US properties.

- Screen Properties with Custom Criteria: Establish detailed purchase criteria and focus on the metrics that are significant to you with DealCheck. Instantly screen properties based on your criteria and identify the best deals promptly.

- Calculate Maximum Allowable Offers: Utilize the offer calculator to ascertain the highest price you can offer to ensure profitability for each deal. The calculator employs reverse valuation and over a dozen criteria to provide an accurate estimate.

- Property Owner Lookup: For those seeking off-market properties, DealCheck enables direct lookup of property owners from the app, facilitating direct mail or lead generation campaigns.

- Share Custom-Branded Reports: Generate professional online or PDF reports effortlessly with a single click. Customize these reports with your branding and logo and distribute them to lenders, partners, investors, or clients.

- Cloud Sync on Any Device: Access your properties anytime, anywhere by signing in to DealCheck on any computer, mobile phone, or tablet. Your data is securely synchronized to the cloud for your convenience.

How Does DealCheck Work?

DealCheck utilizes a blend of public records and rental comparables to furnish precise estimations of a property’s potential returns. Users input various data points regarding the property under consideration, including purchase price, projected rehabilitation expenses, property taxes, and expected rental income.

Subsequently, the tool generates multiple essential metrics indicative of a sound investment, such as cash on cash return, cap rate, and internal rate of return. Furthermore, it offers comprehensive cash flow forecasts, factoring in property-related costs, financing expenditures, vacancy rates, and more.

Furthermore, DealCheck can access public records to furnish details on a property’s sales history, current ownership, and tax assessments. This wealth of information proves invaluable during negotiation processes or when validating assertions made by property owners.

How Much Does DealCheck Cost?

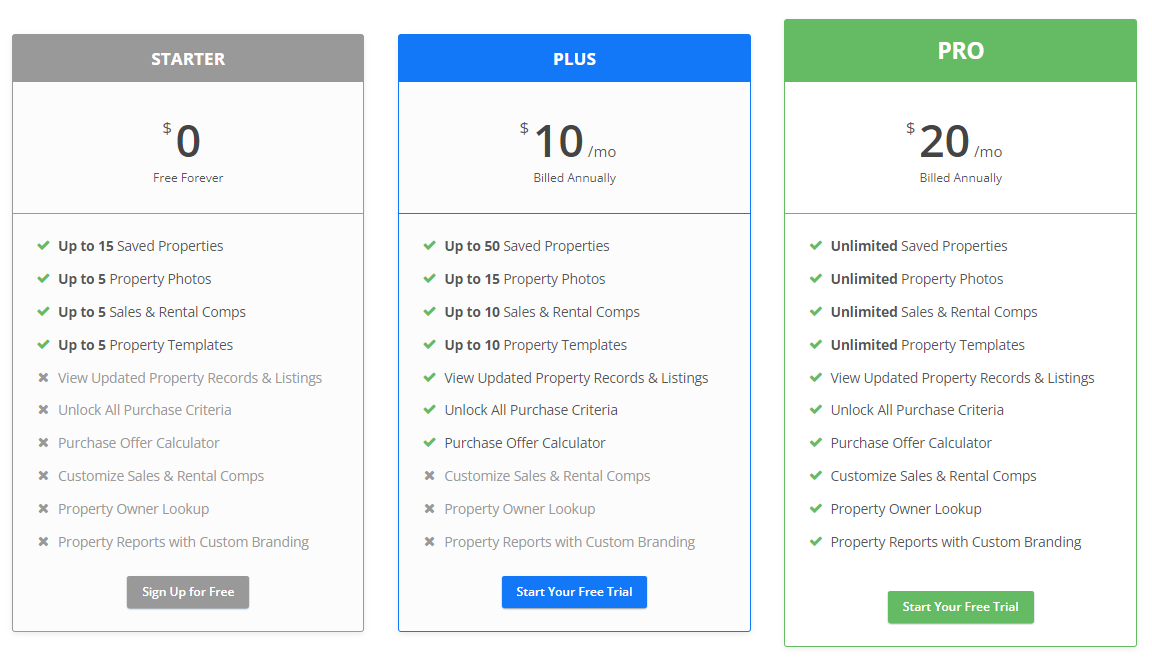

DealCheck provides three pricing options: Starter, Plus, and Pro.

The Starter Plan: This plan is completely free and doesn’t require a credit card for registration. Users can save up to 15 properties, view 5 photos per listing, access 5 sales and rental comparables (comps), and utilize 5 property templates. Additional features include updated property records and listings, unlocking all purchase criteria, using the purchase offer calculator, customizing sales and rental comps, performing property owner lookup, and generating property reports with custom branding.

The Plus Plan: Priced at $10 per month, the Plus plan encompasses all features of the Starter plan with increased limits on saved properties, property photos, sales and rental comps, and property templates – up to 50, 15, 10, and 10, respectively. There’s a 14-day free trial for users to explore the premium features.

The Pro Plan: At $20 per month, the Pro plan grants unlimited access to all features, including saving properties, property photos, sales and rental comps, and property templates without any restrictions. Similar to the Plus plan, there’s a 14-day free trial available.

All premium plans offer exclusive features such as a rental cash flow calculator, house flipping calculator, multi-family & commercial calculator, investment return calculations, cash flow & profit projections, creative financing scenarios, sales & rental comps, property wholesaling tools, professional investment reports, side-by-side property comparison, custom investment criteria, property data import, cloud sync on any device, a nationwide lender directory, and a comprehensive real estate glossary.

DealCheck: Pros & Cons

Pros

Using DealCheck offers a myriad of advantages:

- In-depth Property Assessment: DealCheck conducts meticulous evaluations of each property, encompassing cash flow forecasts, prospective return rates, renovation expenses, and closing expenditures. This functionality proves invaluable for investors seeking a comprehensive understanding of a property’s potential profitability.

- User-Friendly Interface: The platform boasts exceptional user-friendliness, featuring a sleek and intuitive interface. Both the web and mobile applications are seamlessly navigable, facilitating convenient property analysis even while on the move.

- Property Records Accessibility: DealCheck retrieves data from public records, granting users access to a wealth of property information, including its sales history, current ownership details, and tax assessments. This capability can greatly aid potential investors, especially during price negotiations.

Cons

Despite its many advantages, DealCheck does come with a couple of drawbacks:

- Restricted Features in the Free Version: Although the complimentary version of DealCheck provides access to some useful tools, the complete set of features is exclusively offered through a paid subscription plan.

- Learning Curve for New Users: Despite its user-friendly interface, newcomers may require some time to grasp and utilize all of DealCheck’s features effectively.

Final Thought

DealCheck stands out as a robust solution catering to the needs of real estate investors seeking to assess and contrast potential investment properties. Boasting an intuitive interface, comprehensive property reports, and a plethora of analysis tools, it streamlines property evaluation, enabling investors to expedite decision-making with greater insight and efficiency.

In conclusion, our assessment of DealCheck is overwhelmingly positive. It emerges as a valuable asset for any real estate investor, thanks to its extensive feature set and user-centric design, effectively facilitating the property analysis process and earning its place as a fundamental tool in an investor’s toolkit.