Koyfin stands out as an excellent tool for navigating the stock market across diverse asset classes, providing a compelling alternative to Yahoo Finance.

The dynamics of the stock market have undergone significant changes compared to a decade or two ago. In the present day, we are inundated with an abundance of information and noise. Traders must adeptly maneuver through this intricate landscape, sieving through the complexity to extract only the most pertinent and valuable news.

Regardless of whether your investments span stocks, ETFs, futures, FX, or other instruments across various market sectors, the critical factor influencing your success lies in the data and analytical tools that complement your strategy. In the past, acquiring such tools might have incurred substantial monthly costs. However, Koyfin has revolutionized this landscape.

This comprehensive review of Koyfin delves into every aspect of one of the most user-friendly financial data platforms available. Does it merit a place among the top free stock research websites, and is it a worthwhile investment? Let’s explore and discover the answers.

What is Koyfin

Koyfin is an online market dashboard and financial analytics platform that encompasses a wide range of financial instruments, including global stocks, bonds, FX, commodities, mutual funds, cryptocurrencies, and ETFs. The platform offers users a continuous flow of market, financial, and economic data, along with real-time financial market news, facilitating the monitoring of the latest developments at both macro and company levels.

Crafted by former Wall Street professionals, Koyfin aims to democratize access to information by providing retail traders with the same tools used by industry experts, all at a fraction of the cost. In fact, most of the essential features are available for free!

Koyfin’s dashboards effectively distill the vast amount of available information into user-friendly modules, presenting data in an intuitive manner. Below, you’ll find beautifully designed charts, tables, matrices, heatmaps, and other visualization tools.

In essence, Koyfin stands out as one of the most efficient platforms for conducting comprehensive top-down and bottom-up research.

Features Of Koyfin

Koyfin’s platform is rich in advanced functionalities, encompassing technical analysis tools, price charts, data visualization tools, data dashboards, drawing tools, watch lists, market sectors overview, and more.

The Advanced Graphing feature, as its name implies, provides powerful charting tools for enhanced information visualization. The user-friendly, intuitive, and interactive overview dashboards and graphs are highly customizable. Users can plot information across all supported assets, tailoring price charts to their unique trading needs and investment methodologies.

With Koyfin’s robust drawing tools, traders can integrate technical and fundamental data to identify signals and track historical performance, utilizing over 100 technical, fundamental, and valuation indicators. Notes and highlights can be added to price charts, and users have the flexibility to export, share, and save graph templates. This feature makes Koyfin an excellent choice for businesses, such as wealth managers, needing to illustrate ideas to clients. Generated graphs or price charts can be easily embedded on websites or shared with colleagues, clients, and fellow traders.

The “My Dashboard” feature unifies all account information under a convenient and easy-to-navigate interface, eliminating the need to switch screens or browse through Koyfin. Users can create custom watch lists across different asset categories, tailored to their trading style and preferences. There are no restrictions on the number of watch lists, allowing for separate dashboards for various asset classes or client portfolios.

Koyfin provides the luxury of performing in-depth financial analysis under one roof. The platform’s comprehensive financial analysis includes unrivaled access to fundamental metrics, valuations, financial statements, company snapshots, and more. Quarterly results are available for the past two years, while annual results span five years. The platform’s structured information reduces the complexity of financial statement analysis, focusing on key metrics used by securities analysts.

The Macro Dashboards feature offers users 360-degree coverage of various markets and actionable insights, covering currency and securities prices, macroeconomic indicators, and global trends. This feature helps users analyze and hedge their portfolios against global macro risks by consolidating essential information in an easy-to-navigate view. The standalone World Economics dashboard includes critical economic indicators and an Economics Calendar page covering each country’s economic data releases.

Despite not offering an API, Koyfin justifies its decision, citing existing restrictions from data providers and a focus on analytics business without interfering with specialized API partners.

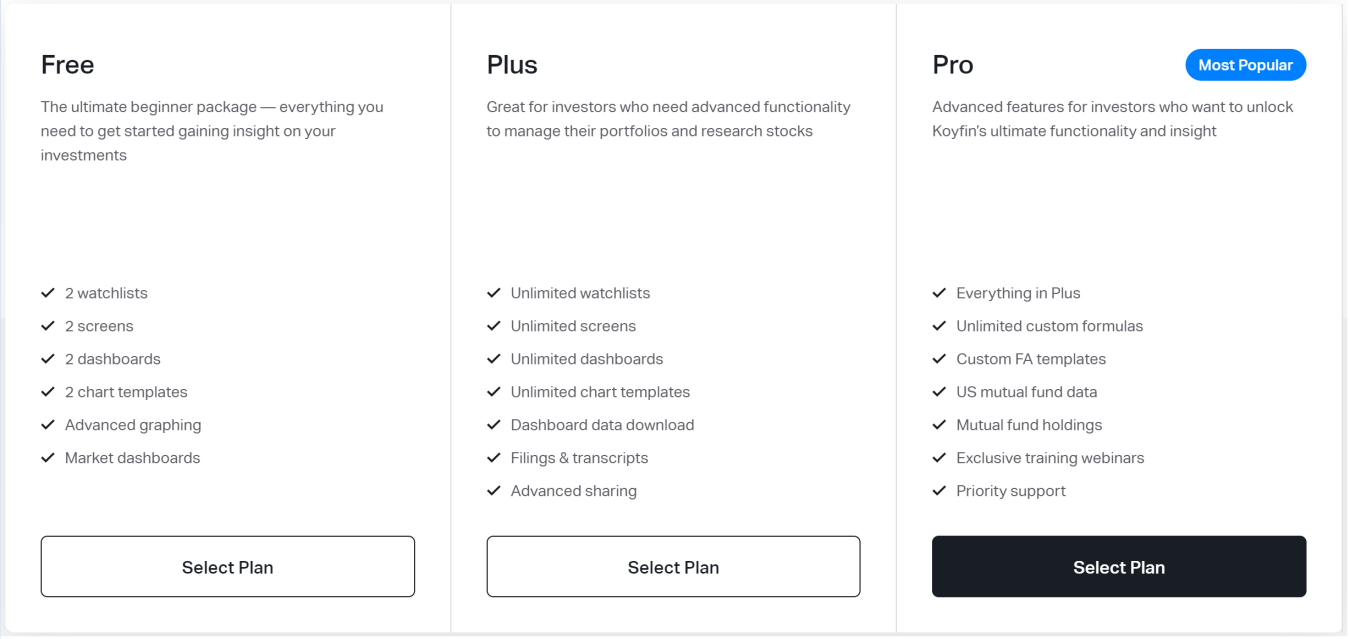

Koyfin Is Pricing

Koyfin provides three subscription plans. The free plan serves as an excellent entry level for beginners aiming to grasp the platform’s functionalities. It encompasses two watchlists, screens, dashboards, chart templates, and advanced graphing features. Moving on to the paid options, the Plus plan, priced at $45 per month or $420 annually, elevates the limits on watchlists, screens, dashboards, and chart templates to unlimited usage. It also unlocks additional benefits such as data downloads, access to filings, and transcripts. For those seeking even more extensive capabilities, the Koyfin Pro plan, available at $100 per month or $840 annually, offers unlimited custom formulas, US mutual funds data, access to training webinars, and priority support.

Koyfin FAQs

Is Koyfin Good?

After utilizing Koyfin for an extended period, I can affirm that it is likely the closest option for retail traders to access a Bloomberg terminal at an affordable price. And that statement holds significant weight!

Is Koyfin Reliable?

In the course of my evaluation of Koyfin, I did not experience any issues regarding its reliability. All functionalities performed as expected, and the data originates from reputable vendors such as IEX & S&P Capital IQ.

Is Koyfin Data Live or Delayed?

For US stocks, the pricing information comprises real-time data from IEX and 15-minute delayed data from the consolidated exchange tape. Canadian price data experiences a 15-minute delay. In the case of all other countries, the price data is based on end-of-day values.

Is Koyfin Free?

Koyfin offers a complimentary plan that grants access to a majority of its features, albeit with specific limitations. To unleash its complete capabilities, upgrading to one of its premium plans is necessary.

Final Thought

In many aspects, the process of conducting this Koyfin review transported me back to my days in the hedge fund, where my gaze remained fixed on a Bloomberg terminal throughout the day.

While it may not rival a $25,000 piece of equipment, I found numerous parallels nonetheless. The comprehensive global data coverage, real-time news, screener functionality, and even the layout of the financial analysis module all exuded the professionalism expected from a high-quality platform. Compared to other similar services I’ve tested, Koyfin stands out as one of the top choices for consolidating all necessary information and tools in a single, user-friendly interface.

Moreover, the fact that most of these tools are available for free explains why many individuals opt for Koyfin as their primary financial market portal. If you aim to enhance your investment analysis, I believe it’s certainly worth giving it a try.

As mentioned at the beginning of this review, Koyfin’s mission is to democratize institutional-grade research capabilities.

In conclusion, I can affirm that they have successfully fulfilled their mission.